Strategy

Influencer Marketing Effectiveness – Partnership KPIs To Watch, Strategies To Scale – Research

As brands seek out the best influencer partners, the standard metrics of yesterday are becoming less useful. While high like and follower counts help influencers establish credibility, engagement rates and sales conversions can be more predictive of a marketing campaign’s success. Here, NetInfluencer dives into a report by Tubular which highlights why going beyond likes and views matters.

When it comes to how brands identify the right influencer partners, analyzing the right metrics is essential. In the past, many companies relied on key social media statistics like reach and subscriber count to select their ideal influencer partners. However, data suggests that getting a bit more granular can help a brand find the perfect fit.

In a recent report by Tubular, the firm reviews metrics on several top social media influencers to determine how effective they are in terms of engagement and shopping affinity. The report also takes a look at overlapping audience interests and how they can help a brand broaden their influencer partnership horizons. Keep reading to learn more about the results of Tubular’s report: The Influencer ID Guide: Going beyond likes & views to secure quality partnerships.

Who Conducted the Survey?

Tubular Labs is a social video intelligence company. They provide their customers with a “unified view” of the content, interests and behaviors of their ideal audiences across major social media platforms, including YouTube, Instagram, Facebook, Twitch, and Twitter. Tubular boasts the largest social video database, covering over 11 billion videos and 28 million unique content creators. Through their solutions, Tubular helps brands and organizations grow their business and leads on social media by anticipating trending content and creators.

Tubular is also part of the Global Video Measurement Alliance, a group made up of the world’s leading brands and media companies working together to define the standards for digital video. Members include Buzzfeed, BBC Studios, and Paramount. Tubular is currently headquartered in Mountain View, California and reportedly has between 101 and 250 employees.

Survey Methodology

In this report, Tubular collected data from popular influencers across top social media platforms to highlight the importance or proper influencer identification practices. The influencers a brand chooses to partner with can make or break a brand’s campaign. The Tubular team focused their report on the following three areas:

- Understanding quality viewership over quantity

- Unlocking consumer behaviors within a specific audience

- Reaching for creators from adjacent categories

The goal of the report is to help brands base their influencer partnership decisions on the most meaningful measurements. According to the data, metrics like the number of active shoppers, how long viewers spend watching an influencer’s video content, and what else a target audience watches across platforms can matter more than like and follower counts.

Three Key Takeaways

1. Subscriber or follower count isn’t always a reliable predictor of engagement. To identify the right influencer partners, brands should consider digging deeper into metrics. Quality sometimes matters more than quantity.

2. Broad and impressive reach and watchtime statistics may not necessarily translate into impressive sales conversion rates.

3. Brands who feel “tapped out” of influencers in their current niche should consider those in adjacent categories. Many top influencers have audiences with overlapping interests, which can broaden a brand’s customer base.

What Does This Mean for Influencer Marketing?

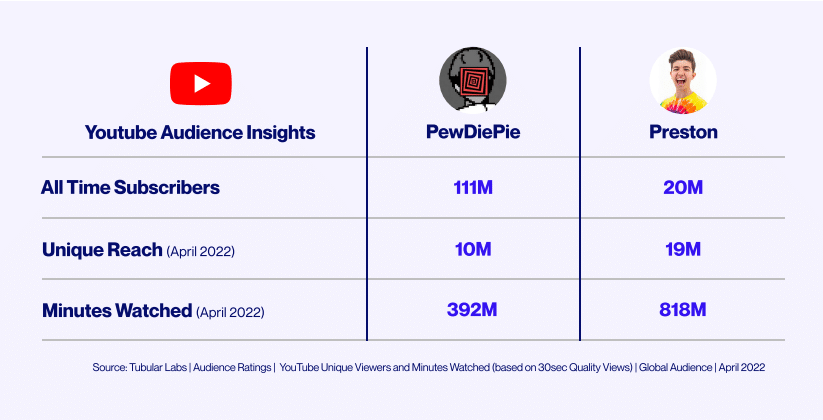

The first takeaway comes from the first portion of the report which compares key YouTube metrics on two top influencers: PewDiePie and Preston. As the graphic below shows, PewDiePie has a significantly higher subscriber count than Preston. However, Preston outperforms PewDiePie in both unique reach and minutes watched. Additionally, Tubular points out that 94% of Preston’s subscribers tuned into his content during April of 2022.

These statistics are good news for influencers with smaller audiences, as brands are paying more attention to how engaged their audience is over how many followers or subscribers they have. Although many brands require influencers to have a certain size audience in order to be considered for partnerships, if you have the data that proves your smaller audience is highly engaged, they may make an exception. Tubular suggests using influencers with captive audiences for mid-funnel campaigns.

The second takeaway looks at the relationship between reach and shopping affinity, which refers to sales conversion rate. The graphic below shows that fitness influencer Larry Wheels has an impressive reach, but a low shopping affinity. However, in the opposite corner of the chart, The Kneesovertoesguy has low reach metrics, but very high shopping affinity. In fact, The Kneesovertoesguy’s audience is 16 times more likely to shop for fitness and exercise products than other audiences.

At the end of the day, the bottom line matters, so Tubular suggests brands take shopping affinity into consideration in addition to reach. Influencers without impressive reach numbers may still be able to win over potential brand partners with high sales conversion rates. Here, having accurate, up-to-date sales conversion numbers is key and those figures should be included in your pitches to help you tell your story.

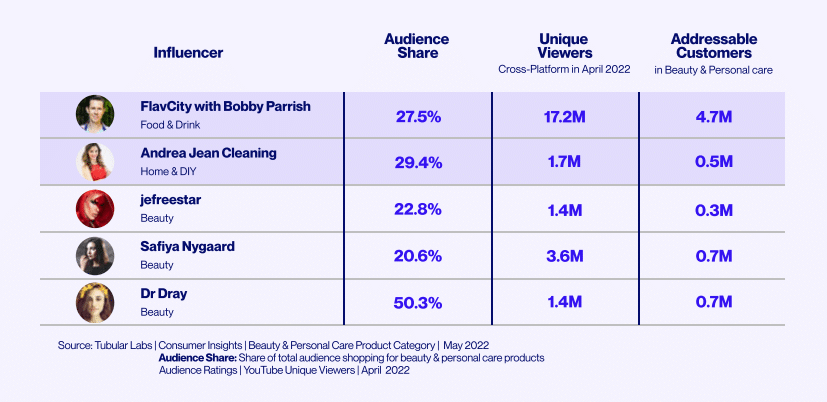

The third takeaway highlights the importance of brands exploring adjacent interests when selecting influencer partners. Over time, a brand may feel like they’ve run out of potential influencer partners, however working with those in an adjacent niche could be beneficial. Many audiences have overlapping interests with each other, such as cleaning and personal care. As the below graphic shows, both FlavCity with Bobby Parrish (food and beverage) and Andrea Jean Cleaning (home and DIY) have audiences that shop within the beauty space.

Over time, influencers may feel tapped out of potential brand partners as well. They can apply this same principle when expanding outside of their niche. Influencers should spend time getting to know the shopping patterns of their audiences to identify potential overlapping opportunities.

Overall, Tubular’s report has valuable insights for both brand partners and influencers, highlighting the importance of “looking under the hood” at more specific social media statistics. Traditional, high-level metrics like subscriber count and reach only tell part of the story. The data in this report suggests a trend of brands getting more granular with how they select influencer partners.

Link to the Report

The full The Influencer ID Guide: Going beyond likes & views to secure quality partnerships report can be found on Tubular’s website, along with additional insights and case studies on social media and influencer marketing.

![Why Beauty and Fashion Brands Are Shifting to Nano, Micro Influencers with Average Engagement Rates [REPORT]](https://www.netinfluencer.com/wp-content/uploads/2024/11/Why-Beauty-and-Fashion-Brands-Are-Shifting-to-Nano-Micro-Influencers-with-Average-Engagement-Rates-REPORT-400x240.png)

![Why Beauty and Fashion Brands Are Shifting to Nano, Micro Influencers with Average Engagement Rates [REPORT]](https://www.netinfluencer.com/wp-content/uploads/2024/11/Why-Beauty-and-Fashion-Brands-Are-Shifting-to-Nano-Micro-Influencers-with-Average-Engagement-Rates-REPORT-100x100.png)