Technology

Baidu Acquires JOYY’s Streaming Business In China For $2.1B To Strengthen Digital Video Presence

Baidu announced it finalized its purchase of JOYY’s China live-streaming unit YY Live for approximately $2.1 billion.

The deal revives an acquisition initially agreed upon in 2020 that failed to receive regulatory approval and collapsed in January 2023.

As per Reuters, the transaction represents a significant reduction from the original $3.6 billion agreement reached during the pandemic. JOYY had already received about $1.86 billion in February 2021 as part of the initial arrangement, with an additional $240 million paid on Tuesday, February 25, 2025, to complete the acquisition.

Baidu’s successful purchase follows Beijing’s softened regulatory stance toward the technology sector after the crackdown that began four years ago. The companies have been in discussions to resolve the situation since the original deal fell through, though specific catalysts for the reversal remain undisclosed.

Strategic Implications for Digital Video Market

The acquisition positions Baidu to diversify revenue streams and compete more effectively with dominant players in China’s online entertainment space, particularly ByteDance’s Chinese TikTok counterpart, Douyin.

China’s short video market is expected to record a value of $179.24 billion in 2026. Furthermore, China’s live-streaming market is anticipated to reach $103.39 billion in 2026.

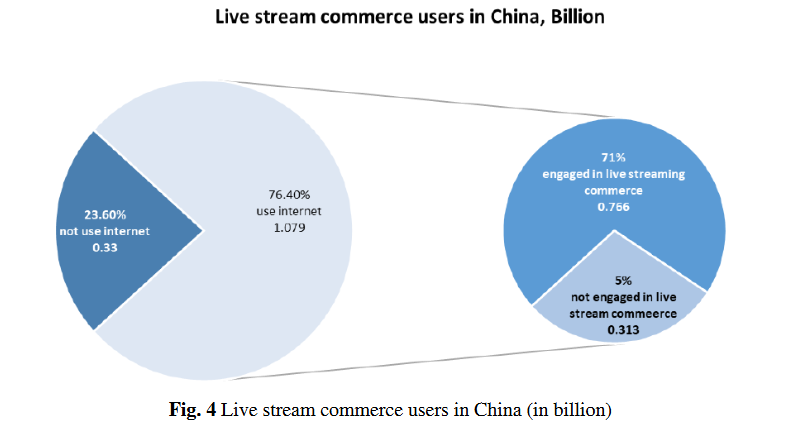

Live e-commerce started in China in 2016. In June 2023, around 765 million people in China engaged in live-streaming commerce, representing 71% of the country’s population then, according to China Marketing Corp, cited in a study from Highlights in Business Economics and Management.

Source: Overview of China’s Live Commerce Market: Douyin Case Study

According to EMARKETER, retail social commerce sales in China are projected to reach $899.57 billion this year, while U.S. sales are expected to total $71.62 billion. Douyin reported $500 billion in social commerce sales in 2023, significantly outpacing TikTok’s performance of less than $4 billion.

For Baidu, the deal complements its existing presence in the streaming market through its U.S.-listed subsidiary iQIYI, often described as China’s equivalent to Netflix. iQIYI has faced growth challenges amid intense competition from both startups and established competitors like Tencent and Alibaba’s Youku, with its shares declining nearly 60% last year.

The purchase also frees up approximately $1.6 billion previously held in escrow accounts as part of the 2020 agreement. These funds could support Baidu’s expansion in artificial intelligence and cloud computing, potentially providing resources for equipment needed to compete in an AI market increasingly influenced by low-cost models from companies like DeepSeek.

U.S.-listed shares of Baidu rose 1% in premarket trading following the announcement, while JOYY’s shares jumped 6%.